Airbus, Boeing and Embraer Total 223 Aircrafts Delivered in the Third Quarter of 2021 (3Q21)

Flights have already started to be resumed with the

reopening of borders and with the last stages of people being vaccinated to

fight the pandemic. For the fourth quarter, it will already be possible to have

superior results with the travel and airlines sector. The three largest

commercial aircraft manufacturers (Airbus, Boeing and Embraer) have already

released their third quarter results. It is noteworthy that the recovery is

slow and gradual, but that it is already possible to see improvements with positive

results.

Including the three largest manufacturers (Airbus, Boeing

and Embraer), a total of 223 aircraft were delivered (194 narrowbody and 29

widebody), a reduction in 42 aircraft deliveries compared to the second quarter

of the year. In fact, the numbers have dropped, but it's also understandable

that airline operators are looking for used aircraft in good condition from

leasing companies that are being offered at low prices to operators.

During the third quarter of 2021, the most delivered

narrowbody aircraft (or single-aisle) was the Airbus A320neo with a total of 58

deliveries, while the most delivered widebody (or double-aisle) aircraft was

the Airbus A350-900XWB with 6 deliveries and the Boeing 767-300F freighter also

with 6 deliveries.

As for orders, in 3Q2021, together with the three largest

manufacturers, there were a total of 248 orders (205 narrowbody and 43

widebody), a reduction of 225 aircraft ordered compared to the second quarter

of 2021. The narrowbody aircraft most ordered in the period was the Airbus

A321neo with 87 orders. The most ordered widebody was the Boeing 777-200F

freighter with 23 orders.

Airbus, Delivery Leader in the Third Quarter of 2021

During 3Q2021, Airbus delivered a total of 127 commercial

aircraft (117 narrowbody and 10 widebody), a reduction of 45 aircraft delivered

compared to the previous quarter over the year. Total orders were 105 aircraft

(98 narrowbody and 7 widebody), a reduction of 21 aircraft ordered compared to

the previous quarter.

The A320neo and A350-900 XWB led as the most delivered for

the third quarter.

The Airbus A320neo aircraft has been the most delivered over

the year 2021, but in the third quarter, the European manufacturer had 10 fewer

aircraft delivered compared to the second quarter – a total of 58 deliveries in

the third quarter. The widebody aircraft most delivered by the manufacturer was

the A350-900XWB with 12 fewer deliveries compared to the previous quarter. As

mentioned at the beginning of this publication, a total of 6 A350-900XWB

aircraft were delivered.

As for orders, the Airbus A321neo was the narrowbody most

ordered by the European manufacturer, with 87 orders. Airbus most ordered

widebody was the A330-900neo with 7 orders.

The European manufacturer continues to lead in 2021 with a

total of 424 deliveries, 270 orders and a large number of orders in a total of

6,894 aircraft.

According to DSM Forecast International, prior to the

pandemic, Airbus was targeting a 5 percent rate increase from A320 to 63 jets

per month starting in 2021 and was also discussing an additional increase with

its supply chain that it could have. Brought the production rate of up to 67

aircraft per month, or 804 per year, by 2023. This would put the company within

reach of 1,000 jet deliveries per year. Those plans have now been shelved. In

January 2021, Airbus released an updated production rate plan and has since

increased production of the A320 from a rate of 40 per month to 43 in Q3 2021,

and expects to reach 45 in Q4. Airbus recently called suppliers and asked them

to prepare for a fee of 64 by the second quarter of 2023.

The A220, in turn, is being produced at a rate of five

aircraft per month; the rate will be increased to six in early 2022. The A350

production rate currently averages five per month and will be increased to six

in the fall of 2022. A330 production remains at an average monthly rate of two

per month without plans to increase it for the foreseeable future. With just

three A380s in stock as of September 30, 2021, the end of the A380 program is

approaching. The last aircraft is expected to be delivered to Emirates in May

2022.

Boeing, Orders Leader in the Third Quarter of 2021

The MAX family of aircraft has gained the confidence of

operators after the improvements made by the US manufacturer Boeing with the

resumption of operations of the MAX family aircraft in November 2020.

Boeing saw a reduction of 206 aircraft orders in the quarter

with a total of 111 aircraft (75 narrowbody and 36 widebody). Deliveries

increased by 8 more aircraft compared to the second quarter of the year.

The Boeing 737 MAX 8 was the manufacturer's most delivered

narrowbody aircraft in the third quarter of 2021 with 56 aircraft, an increase

of 15 aircraft for the MAX 8 version compared to the previous quarter over the

same year. The widebody most delivered in 3Q2021 by Boeing was the Boeing

767-300F freighter with 6 aircraft.

According to Boeing, the 737 program is currently producing

at a low rate and continues to expect to gradually increase production to 31

per month in early 2022 with further gradual increases to match market demand.

Boeing will continue to evaluate the production rate plan as it monitors the

market environment and engages in discussions with customers.

During the previous quarter the MAX Family set a new order

record, United Airlines placed an order for 200 MAX aircraft (50 Boeing 737 MAX

8 and 150 Boeing 737 MAX 10), the order became the largest order for the

version of the MAX 10, as it did during the first quarter with a record orders

placed for the MAX 7 by Southwest Airlines after the operational resumption of

the MAX family of aircraft.

A curious fact is the number of orders for cargo aircraft

over the second and third quarters. With the pandemic, the e-commerce sector

together with the air cargo sector made companies such as: Fedex, Lufthansa

Cargo, Silk Way West, Qatar Cargo and another operator in secrecy – boosting

orders for Boeing 767F and Boeing 777F cargo aircraft.

No Boeing 787s were delivered in the third quarter after

Boeing halted deliveries in May – for the second time in less than a year. The

Federal Aviation Administration (FAA) is reviewing Boeing's method of inspecting

and evaluating aircraft to ensure it meets federal safety regulations. The FAA

is also investigating whether modifications are needed on 787s that are already

in service by airlines; however, the regulator has also made it clear that the

issue does not pose an immediate threat to flight safety. According to Boeing,

the company continues to conduct comprehensive inspections throughout the 787's

production system and supply chain, maintaining "detailed and transparent

discussions with the FAA, suppliers and customers." With inspections and

rework consuming significant production resources, the 787's production rate

remains below the normal rate of five planes a month.

Boeing closed the first half of 2021 as the largest

manufacturer with the most orders, a total of 599 aircraft. 434 more aircraft

on order than its competitor Airbus, which obtained a total of 165 aircraft on

order in the same semester.

Even with this large number of orders in the first half of

2021, Boeing has a total of 4,163 aircraft orders, a lower number than its

competitor Airbus which has 6,894 order orders.

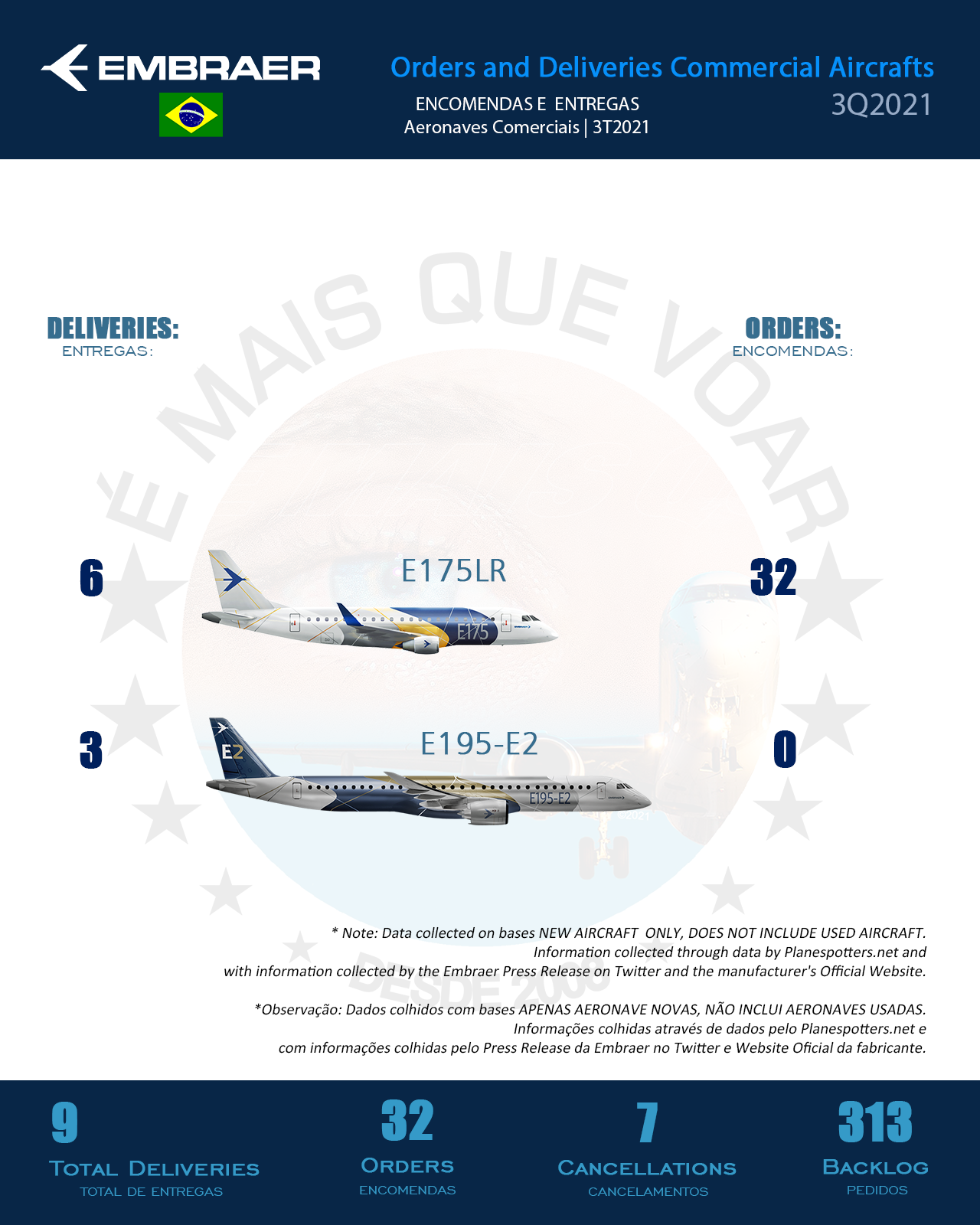

The Brazilian Embraer

The Brazilian manufacturer Embraer, according to its

official statement with Investors, delivered a total of 30 jets in the third

quarter of 2021, including nine commercial and 21 executive. As of September

30, 2021, the firm order backlog (backlog) totaled USD 16.8 billion.

The new E175LR was the most delivered in the period with a

total of 6 deliveries. The same number of deliveries compared to the previous

quarter.

During the third quarter of 2021, Embraer announced the sale

of 16 new E175 jets to SkyWest, Inc. to operate for Delta Air Lines, adding to

the 71 jets of the model that SkyWest already operates for the airline. The

E175 aircraft will fly to Delta under a Capacity Purchase Agreement (CPA). The

contract value, which is included in Embraer's third-quarter backlog, is $798.4

million, based on list price.

In the Services and Support segment, Embraer signed several

contracts in the quarter. Porter Airlines signed a major after-sales support

package with Embraer, for up to 20 years, for the E2 commercial aircraft fleet.

Embraer also signed a Pool Program agreement with CommutAir, operator of United

Express, to support the ERJ 145 jet fleet, and a Pool extension with Cobham,

Australia, to support its three E190s. In addition, also in Australia, Embraer

signed a service agreement with Alliance Airlines, providing support for the

airline's E190 fleet.

Another relevant fact was the last delivery of the Embraer

170 aircraft, which took place during the second quarter of 2021. The Embraer

170 has had a total portfolio of 171 aircraft since its launch.

Embraer's total orders ended the third quarter of 2021 with

9 commercial aircraft, 5 aircraft less compared to the previous quarter.

Embraer ended the third quarter of 2021 with 313 orders for

commercial aircraft (151 Embraer 175, 3 Embraer 190, 5 Embraer 195-E2 and 154

Embraer 195-E2).

Nenhum comentário:

Postar um comentário